Market Resilience: How Indian Stocks Weather Security and Diplomatic Crises?

Indian equity markets have consistently demonstrated notable resilience in the face of geopolitical shocks, particularly during episodes of conflict or heightened tensions with Pakistan. The recent Pahalgam attack and subsequent military and diplomatic actions provide a clear example of this phenomenon, echoing patterns observed over the past three decades.

Historical Context: Market Resilience Amid Conflict

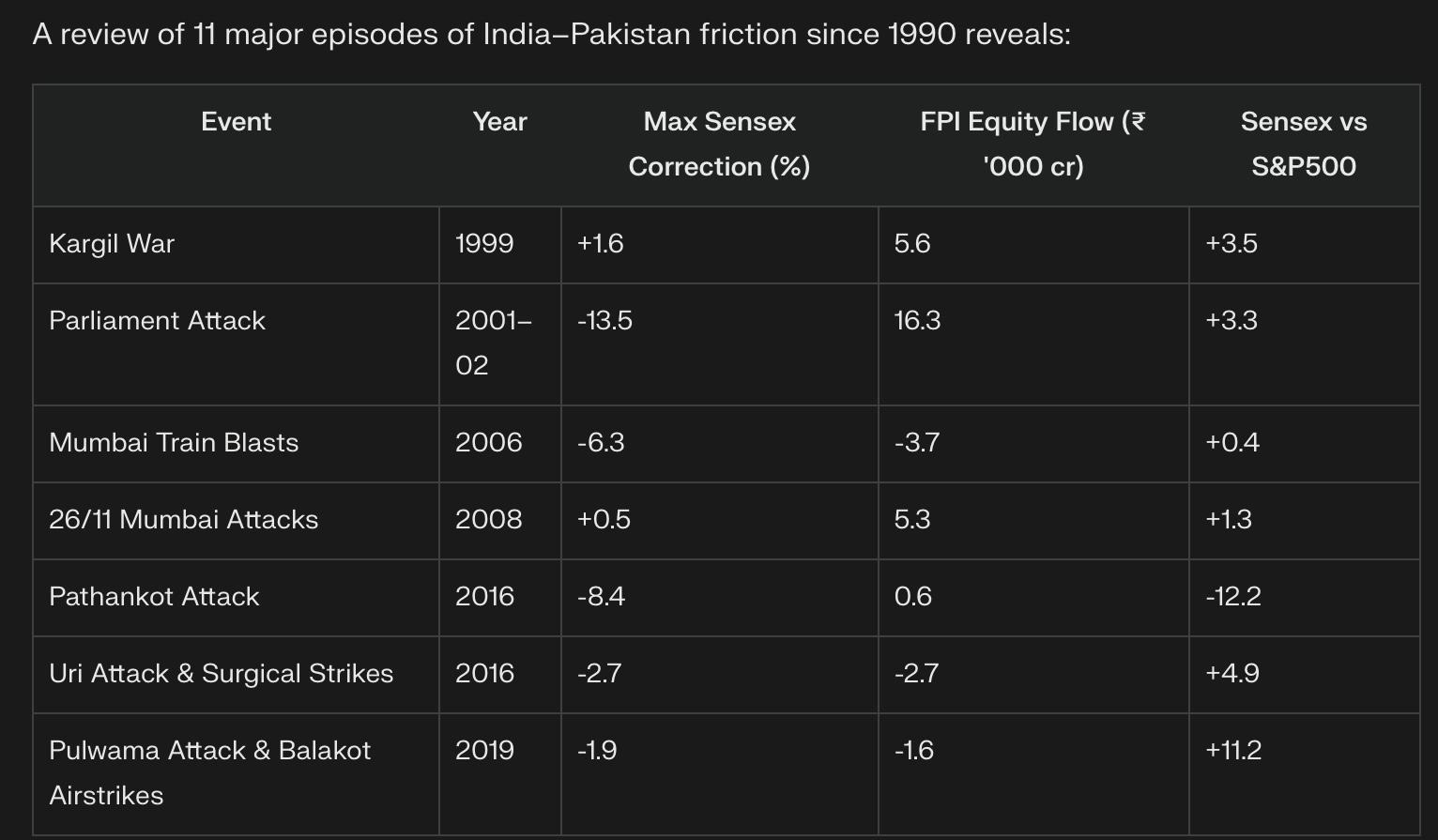

Since the 1990s, Indian markets have weathered numerous high-stakes incidents-including the Kargil War, Parliament attacks, Uri, and Pulwama-without suffering major or lasting corrections. The Sensex, India’s benchmark equity index, has repeatedly shown only modest, short-lived declines during such periods. Corrections, when they occur, tend to be sentiment-driven and quickly reversed as market fundamentals reassert themselves.

Key Reasons for Market Calm

Several factors underpin this remarkable market composure:

- Low Probability of Full-Scale War: Despite heated rhetoric and military posturing, both India and Pakistan have historically avoided escalation beyond tactical thresholds. The risk of uncontrolled war-especially given nuclear capabilities and international diplomatic pressure-remains low.

- Investor Focus on Fundamentals: Market participants have become adept at distinguishing between geopolitical “noise” and economic fundamentals. Earnings growth, liquidity, policy direction, and macroeconomic stability continue to drive investment decisions, outweighing short-term security concerns.

- Swift Market Recovery: Data from past crises shows that even at the peak of hostilities, markets have rebounded swiftly. For example, during the Kargil War (1999), the Sensex actually rose 1.6%, and during the Parliament Attack standoff (2001–02), the Sensex outperformed the S&P 500 by a large margin, with positive foreign portfolio investment (FPI) flows in both cases.

- Domestic Macro Strength: The broader market narrative is shaped more by India's domestic economic performance than by external fault lines. Strong GDP growth, stable inflation, and robust corporate earnings provide a buffer against external shocks.

Empirical Evidence: Past Episodes and Market Impact

The median correction across these events is just -3.5%, with many episodes showing positive or neutral market performance. FPI flows have often remained positive or quickly recovered.

Sectoral Impact

While the broader market remains stable, certain sectors may experience short-term volatility:

- Tourism and Aviation: Regions directly affected by conflict, such as Jammu & Kashmir, may see negative impacts on tourism and aviation due to cancellations and security concerns. However, the effect on major listed companies is generally limited.

- Defence: Defence-related companies often benefit from increased government spending and heightened security focus, with positive sentiment for both platform and consumable suppliers.

Why a Full-Scale War Remains Unlikely

Multiple factors deter escalation into full-scale war:

- International Diplomacy: Global powers, especially the US, actively discourage escalation, often intervening diplomatically to de-escalate tensions.

- Nuclear Deterrence: The risk of nuclear conflict acts as a powerful brake on uncontrolled escalation.

- Economic Self-Interest: Both countries, particularly India, have strong incentives to maintain economic stability and growth, discouraging actions that could destabilise markets or investor confidence.

- Strategic Doctrine: India’s security policy has evolved to favor calibrated, limited responses-such as surgical strikes or precision airstrikes-over large-scale mobilisation.

Awadh 360 Plus

Indian equity markets’ calm during conflicts is rooted in a combination of historical experience, investor sophistication, strong economic fundamentals, and a low likelihood of full-scale war. While short-term volatility can occur, structural impacts are rare, and markets typically rebound swiftly as fundamentals prevail.

“Equity and FPI data show that even in peak crisis moments, markets have rebounded swiftly. This time appears no different... The broader market narrative continues to be shaped by India's domestic macro strength, and not by its external fault lines.”

{This analysis is based on the special strategy note “Pahalgam Attack and Aftermath: Strategy” by Sujan Hajra (Chief Economist) and Sweta Jain (Analyst), Anand Rathi Share and Stock Brokers Limited}

Popular Categories

Read More Articles

Travel and Tourism

Travel to Thailand gets costlier: International passenger service fee to jump 53% from June by Awadh 360° Desk February 22, 2026Travel and Tourism

Thailand Extends Visa-Free Stay for Indians to 60 Days, Allows 30-Day Extension by Awadh 360° Desk February 19, 2026Travel and Tourism

Lucknow or Zaike: A City Remembered Through Taste by Mohammed Syed Zaid February 11, 2026Business

What's Up With WhatsApp? by Prateek Shukla February 9, 2026